QUARTERLY FUND REVIEW

Multi-Asset Growth Strategy (MAGS)

Real Return Series

Real Return Fund

Dynamic and risk managed

Multi-Asset Growth Strategy (MAGS)

Real Return Funds Review Q1 2021

Mags 4th Quarter 2020 Real Return Series

https://www.savannapride.com.au/download_file/view/356/239

MAGS 3rd Quarter 2020 Real Return Series

Q2 Real Return Series 2020.pdf

AN UNPRECEDENTED GLOBAL HEALTH CRISIS AND A SURGE IN VOLATILITY PROVES A CHALLENGING MARKET ENVIRONMENT FOR INVESTORS

Here our Multi-Asset Solutions team discusses Russell Investments’ performance in the March quarter and their outlook for 2020.

What drove markets during the first quarter of 2020?

The first quarter of 2020 saw growth assets significantly underperform their defensive counterparts amid concerns the rapid spread of coronavirus outside of Mainland China would push the global economy into recession.

Two key events helped shape market movements over the quarter:

1. Volatility spikes. Market volatility spiked during the first quarter, with the Chicago Board Options Exchange Volatility Index, widely known as the VIX, reaching levels not seen since the global financial crisis. There were some obvious drivers of volatility over the period, but principal amongst these were the threat the coronavirus pandemic posed to global growth and a collapse in oil prices. Despite having performed well for much of the quarter, stocks fell sharply toward the end of February and continued their slide through March as the rapid spread of coronavirus worldwide forced governments to impose strict containment measures. This included the shutdown of all non-essential services and activities, which had the effect of bringing parts of the global economy to a near standstill. Whilst stocks got something of a reprieve late in the period when governments and central banks moved to implement fiscal and monetary policy stimulus aimed at supporting growth, it wasn’t enough to recoup their previous losses. Meanwhile, oil prices fell almost 67% on fears a new price war between major producers Saudi Arabia and Russia would see supply spike at a time when demand was falling. 1 Global shares measured by the MSCI World ex Australia Net Accumulation Index (in AUD)

2. RBA cuts interest rates twice and introduces quantitative easing. The Reserve Bank of Australia (RBA) cut interest rates twice in the first quarter; taking the official cash rate from 0.75% to a new low of just 0.25%. The first of these moves – a 0.25% reduction – came at the Bank’s planned board meeting in early March and was driven by a combination of rising market volatility and evidence the spread of coronavirus would cause major disruption to economic activity globally. The second move came at an emergency meeting on 19 March, when the Bank lowered interest rates a further 0.25% and noted that the cash rate was likely to remain at its current low level for another three years due to the ‘extraordinary’ circumstances at play. This meeting also saw the RBA introduce quantitative easing (QE) for the first time. As part of its QE program, the Bank committed to purchasing government bonds in a bid to keep borrowing costs down. Essentially, the program aims to keep the short end of the yield curve at 0.25%; notably the three-year part of the curve, which is important for the domestic economy given a lot of private business borrowing occurs around the three- to five-year maturity. The RBA also announced a $90 billion, three-year credit facility for banks with incentives to lend to small- and medium-sized businesses. 2 Australian shares measured by the S&P/ASX 300 Accumulation Index

Global shares fell 9.0%1 in the March quarter. Australian shares were also weaker, returning -23.4%2 after the Federal Government moved to shut down all non-essential services and activities. Helping to limit the local market’s decline was the introduction

of various fiscal and monetary policy measures aimed at propping up the economy. Emerging markets equities underperformed their developed counterparts over the period, closing the quarter 12.3%3 lower.

3 Emerging markets measured by the MSCI Emerging Markets Index Net (in AUD)

The Australian dollar (AUD) fell sharply in the first quarter, with the Australian Trade-Weighted Index down 9.3%4. Much of the currency’s decline was driven by the economic disruption caused by the spread of coronavirus, subsequent RBA policy action and steep declines across the commodities spectrum. The AUD was also impacted by general US dollar (USD) strength as investors favoured the currency’s perceived ‘safe-haven’ qualities. 3 Emerging markets measured by the MSCI Emerging Markets Index Net (in AUD)

4 The trade-weighted index for the AUD is an indicator of movements in the average value of the AUD against the currencies of our trading partners. Source: RBA.

Interest rate sensitive assets were mixed for the quarter. Lower bond yields contributed to positive absolute returns for global and domestic bonds, while global listed infrastructure and global and Australian listed property got caught up in the broader equity market selloff we saw over the period.

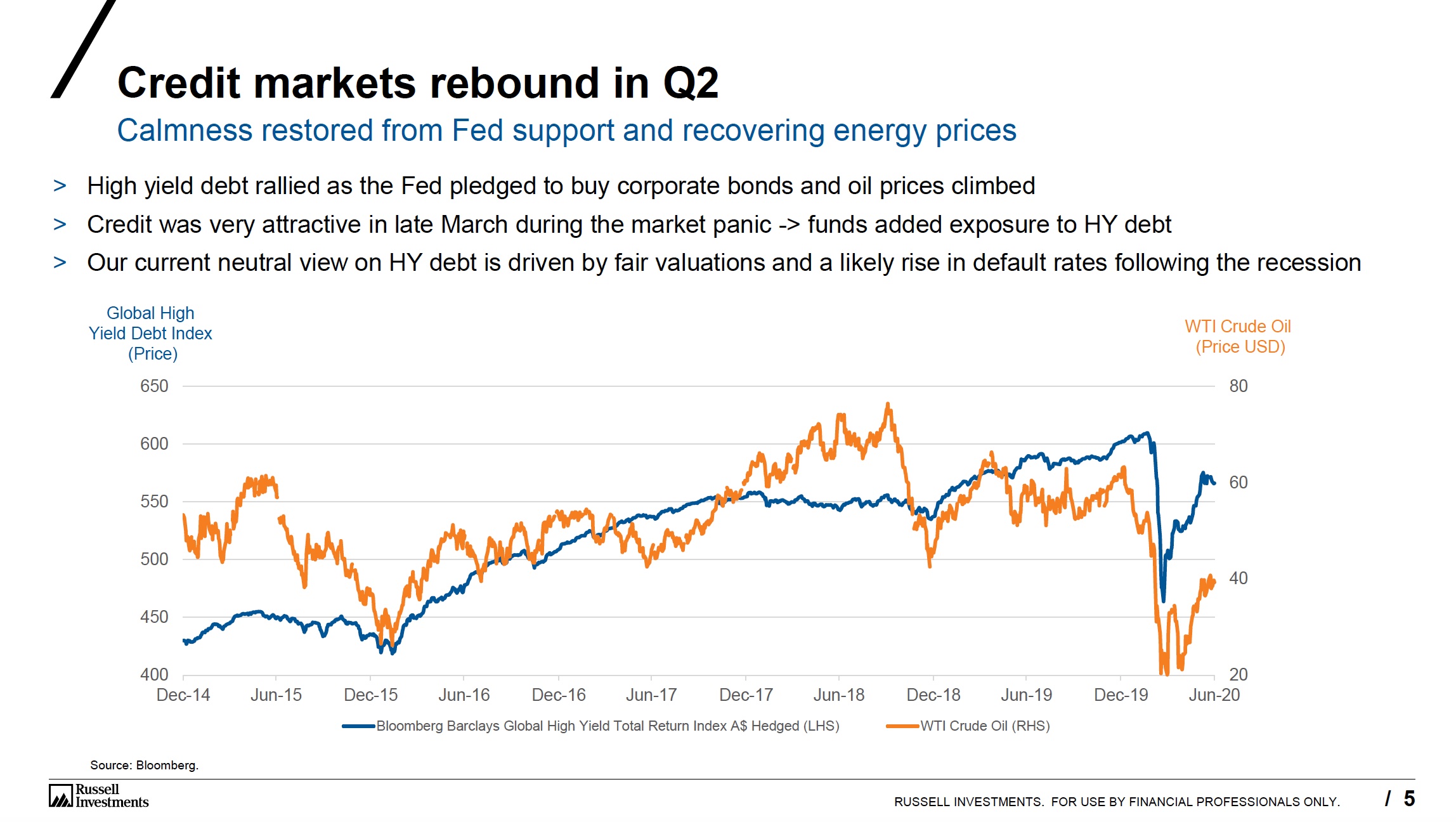

In credit markets, spreads on US and European investment-grade and high-yield debt widened over the quarter amid heightened liquidity concerns and the sharp decline in oil prices. Local currency, hard currency and corporate emerging markets debt were also weaker for the period. 4 The trade-weighted index for the AUD is an indicator of movements in the average value of the AUD against the currencies of our trading partners. Source: RBA

How did Russell Investments’ active multi-asset portfolios perform in the March quarter? What was rewarded by the market and what wasn’t?

Absolute returns. The Russell Investments Balanced Fund returned -14.9% for the quarter on a net of fees and tax basis. Performance was driven primarily by negative absolute returns from the Fund’s equity and credit exposures.

Returns relative to fund benchmark. Relative to its strategic benchmark, the Russell Investments Balanced Fund underperformed by 2.1% on a net of fees and tax basis.

Positive contributors included:

› Positive absolute returns from the Amundi Absolute Volatility World Equities Fund (AUD Hedged).

› Currency positioning; notably an underweight to the AUD and an overweight to the Japanese yen.

Negative contributors included:

› An overweight to equities.

› An overweight to credit, including the Russell Investments Floating Rate Fund.

› Negative excess returns from Australian and global equity sector funds.

What is Russell Investments’ outlook for 2020? How is it impacting your active multi-asset positioning?

The coronavirus pandemic has stalled the mini-cycle rebound and made a global recession likely. Although the duration of the pandemic remains unpredictable, monetary and fiscal stimulus, pent-up demand and a lack of major imbalances argue for a solid upswing when the virus threat eventually clears. Provided the virus is transitory, the global economy should be poised to rebound in the second half of this year. However, whilst equity markets are likely to rebound once the virus is contained, the growth disruption from the virus is likely to trigger a 2020 recession, with global gross domestic product growth likely to be negative in the first quarter and at high risk of contracting further in the second. Progress in containing the virus will have a direct impact on the depth of such a recession.

Our view on global equities remains optimistic. Valuations have clearly improved after recent, large market falls. The outlook is more positive once factoring in the substantial stimulus measures being implemented, even though our near-term outlook is for a recession. Equity markets which have been hardest hit by the virus may be those that benefit the most from the eventual rebound. We believe UK and euro zone equities are attractively priced. Europe’s high weighting to cyclical stocks should help it outperform in the recovery. Emerging markets equities should also benefit from the eventual recovery as they too are attractively valued and have the additional benefit of easing US-China trade tensions. We maintain an underweight to US equities, driven primarily by their expensive valuations relative to these other regions.

For fixed income assets, we continue to see government bonds as universally expensive. Whilst they may rally if the coronavirus pandemic escalates further, they nonetheless remain at risk of underperforming once the post-virus recovery commences. We believe high-yield debt is now very attractively priced. Although there is considerable uncertainty regarding liquidity risks in credit markets, the current spread to US Treasuries has historically been a rewarding point to add exposure.

In terms of currencies, we expect the ‘safe haven’ rally in the USD will unwind once we reach the post-virus recovery phase. This should favour currencies like the British pound, the Australian dollar and the Canadian dollar, which are now significantly undervalued relative to long-term purchasing power parity comparisons.

Moving forward, the major risks to our 2020 outlook include more aggressive and longer containment measures should the coronavirus pandemic re-escalate when current measures are relaxed. The economic impact of the virus may turn out to be larger than expected, with a sharp plunge in cashflows causing highly-indebted companies to default, triggering a credit crunch in the broader economy. Further, it is possible that global supply chain disruptions could have a larger and more sustained negative impact on global growth. Nonetheless, we remain alert to risks and volatility as we enter a likely global recession. Importantly, we believe this is an environment that will favour our active management approach.

https://russellinvestments.com/au/pages/investment-experts-webinar-series

MAGS 4th Quarter 2019

Dynamic Real Return Series Quarterly Fund Review: Q4 2019

Multi-Asset Growth Strategy (MAGS)

MAGS 3rd Quarter 2019

Dynamic Real Return Series Quarterly Fund Review: Q3 2019

Multi-Asset Growth Strategy (MAGS)

MAGS 2nd Quarter 2019

Dynamic Real Return Series Quarterly Fund Review: Q2 2019

Multi-Asset Growth Strategy (MAGS)

MAGS 1st Quarter 2019

Dynamic Real Return Series Quarterly Fund Review: Q1 2019

Multi-Asset Growth Strategy (MAGS)

MAGS Dec 2018

Dynamic Real Return Series Quarterly Fund Review: Q4 2018

Multi-Asset Growth Strategy (MAGS)

QFR - MAGS OCT 2018

Dynamic Real Return Series Quarterly Fund Review: Q3 2018

Multi-Asset Growth Strategy (MAGS)

Read our latest newsletter from Russell Investments

Quarterly Fund Review - Q2 2018