Financial Insights & Updates - June 2021

Welcome to the June edition of Financial Insights and Updates.

With the end of the financial year this month, we have included 2 articles relevant to tax time. “Income Tax Brackets and Rates in Australia” details the tax brackets for the 2020/21 financial year, provides information about taxable income, Budget 2020 tax cuts, tax deductions and offsets and uses examples for illustration. Our article “Advice for couples at tax time” is a quick article explaining the tax implications of being a couple.

A couple of other articles this month worth taking note of include “The greatest challenges facing future retirees” which goes through some concerns that many coming up to retirement have, and “Financial abuse – The unseen side of family violence” which talks about an uncomfortable but important topic. Family violence takes many forms and financial abuse is one of them. And it is not limited to just between couples, but could also be between parent/s and child/ren or grandparent/s and grandchild/ren. No one wants to think someone they love and care for is taking advantage of them financially. If you feel something is not quite right, speak up and let someone you trust know.

In signing off, please remember that we are always available to answer any questions or queries you may have.

Warm regards,

The Team at Savanna Pride

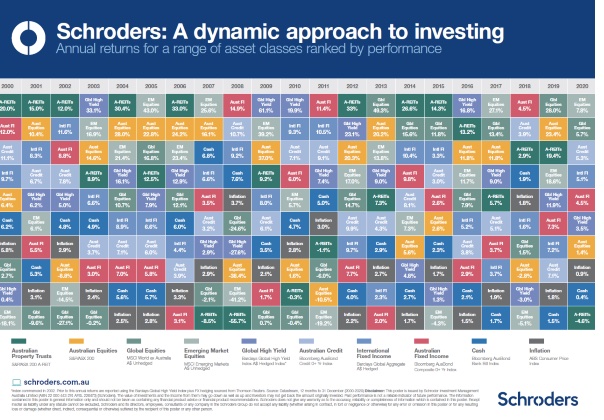

Feature Chart: Schroders: A Dynamic approach to investing

(Please click on the image below to read the chart)

Income Tax Brackets and Rates in Australia: 2020/2021

As long as you’re earning income in Australia or from overseas, you’ll potentially be liable to pay income tax to the Australian Government. So, what is income tax and how much are you required to pay?

This article sets out to explain... Read More

Advice for couples at tax time

If you’re newly married, engaged or living with your partner, you might not be aware that there are some implications for your taxes.

In Australia, you’re not required to lodge a combined tax return with your spouse each year. Instead, you need to declare your spouse’s taxable income on your individual tax return.

The Australian Taxation Office (ATO) uses your joint income to work out whether... Read More

Getting your super back on track

If you experienced financial hardship in 2020, you may have decided to withdraw from your superannuation balance to tide you over. Find out what you can be doing to top up your super and keep your retirement savings on track.

In 2020, the Federal Government announced a number of different types of support for Australians in financial difficulty due to the COVID-19 pandemic. For people who lost their jobs... Read More

ETF’s – an alternative to shares

Exchange Traded Fund investments are gaining popularity but do we really understand them? While they can be low-cost and relatively simple, there are a few other things you should know before hopping on board.

According to research undertaken by Morningstar, Australian investment in Exchange Traded Funds (ETFs) grew by 30.4% in the twelve months ending December 2020 to reach a capitalisation of $79.3 billion (US $60.8 billion)... Read More

The greatest challenges facing future retirees

Most working Australians aspire to the idea that they’ll reach a point where they can retire debt-free and with enough money in their superannuation fund – perhaps supplemented by the age pension – to provide them with a comfortable standard of living in retirement.

For many that remains a reasonable aspiration, but a growing range of challenges mean that retirement goals that could easily be achieved a few years ago look like being harder to achieve in the future... Read More

The ins and outs of private health care

With premiums often running to thousands of dollars per year, whether or not to take out private health insurance is a major financial decision. Here are some of the key issues you need to consider in making that decision.

Why go private?

There are two main types of private health insurance: hospital cover, and general treatment (or extras) cover. In some states you may also need to take out ambulance cover... Read More

Financial abuse: The unseen side of family violence

Cathy knew the relationship was in trouble, but she hung on, hoping it would improve. It was the day she found herself trying to take their three young children to school and about to run out of petrol, that she decided to make a stand.

She put $20 of petrol into her near-empty car and was confident she’d squeeze the amount onto her credit card. Like so many times before, though, her credit card was rejected, and this time, she had no cash. The petrol station called the police and charges were laid... Read More

|

|||||||||||||||||||||||||||||||||

|