10 July 2019

Bob Cunneen, Senior Economist and Portfolio Specialist

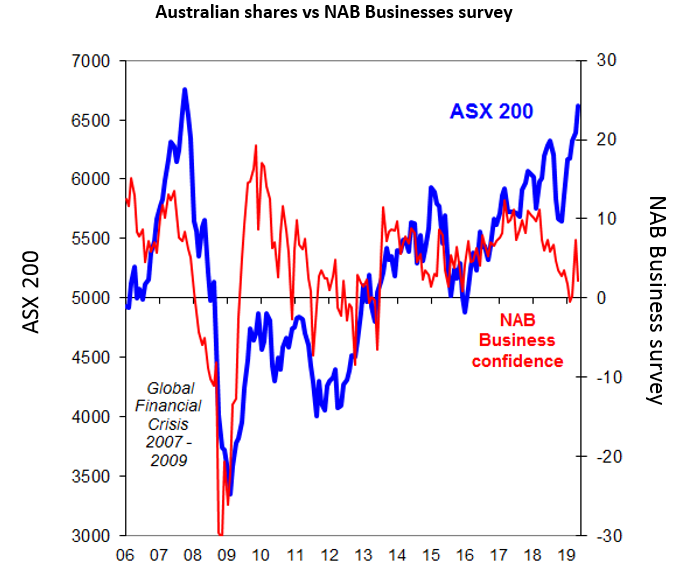

Australia’s share market has delivered strong returns so far in 2019. The ASX 200 share price index (blue line) has risen by over 17% this year and is just 3% below the historic high set back in 2008. This strong surge in Australian shares comes from a combination of positives such as the Reserve Bank of Australia cutting interest rates, a lower Australian dollar as well as strong global share market performance this year.

Judging by this robust Australian share market performance, you could easily come to the view that all is well with the Australian economy. However, the NAB Business survey shows a more concerning assessment. Business confidence has been falling over the past year (red line). A myriad of negative factors such as Australia’s weak housing market, sluggish retail spending and tighter credit conditions appear to be weighing heavily on corporate confidence.

This sharp gulf between a hopeful Australian share market and a more cautious business sector is not sustainable. Something will have to give. Either the Australian share market may have a reality check soon and give up some of this year’s extraordinary gains, or the Australian business sector will respond more positively to the lower interest rates climate. Let’s all hope that the business sector is the one to now positively surprise on the upside.

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.